You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Jlcpcb and tariffs

- Thread starter Locrian99

- Start date

I'm brand new here. Wanting to make an order from Tayda and a PCB from JLC. Curious if DHL will now demand a big tariff payment for my package. Hate this timeframe. Trying to put together a similar order from Mouser or Digikey...but finding similar products from the insane selection there is driving me crazy! Back to PCB design I guess. lol

Looking at it in a balanced way - some of the changes are positive and needed, possibly not great for pedal builders but I think that removal of de minimis on duty is a positive thing - it will stop Chinese fast fashion brands being able to undercut the system of import duties and safety requirements - that overall will be a positive thing for American economy and worker and will give a semblance of fairness to shops trying to operate in the US.

On the other hand, vindictive personal vendettas and personal gifts to the president is a crazy way for any country to manage trade and foreign policy and clearly has to be illegal if that constitution is still something y’all believe in?

As an outsider looking in the speed of the slide into authoritarianism in the US is crazy.

On the other hand, vindictive personal vendettas and personal gifts to the president is a crazy way for any country to manage trade and foreign policy and clearly has to be illegal if that constitution is still something y’all believe in?

As an outsider looking in the speed of the slide into authoritarianism in the US is crazy.

Big Monk

Well-known member

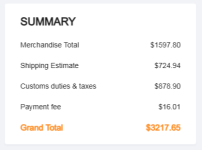

This is an enclosure order including 20 125B and 10 1590XX enclosures. I don't hate it, especially if it's a no-snag option with respect to tarrifs but it is a distinct change. This is about $20 per finished enclosure in the raw sense, but it's obviously skewed by the 1590XX enclosures are twice as much as the 125B:

that's less than 20% including shipping.This is an enclosure order including 20 125B and 10 1590XX enclosures. I don't hate it, especially if it's a no-snag option with respect to tarrifs but it is a distinct change. This is about $20 per finished enclosure in the raw sense, but it's obviously skewed by the 1590XX enclosures are twice as much as the 125B:

View attachment 102240

The rest of the world would pay (subtotal + shipping) x VAT - which in the UK is 20% .

that's less than 20% including shipping.

The rest of the world would pay (subtotal + shipping) x VAT - which in the UK is 20% .

Plus import charge if over 136 IIRC now. It’s all caused mass chaos as all rapid import/export changes do.

pricklyrobot

Well-known member

Except that businesses specifically competing with ‘Chinese fast fashion’ were more likely to be large retail chains and not independent mom-n-pops.Looking at it in a balanced way - some of the changes are positive and needed, possibly not great for pedal builders but I think that removal of de minimis on duty is a positive thing - it will stop Chinese fast fashion brands being able to undercut the system of import duties and safety requirements - that overall will be a positive thing for American economy and worker and will give a semblance of fairness to shops trying to operate in the US.

And of course there’s all the small specialty shops that rely on imports of stuff that will never make sense to manufacture in the US. Just read an article about a shop that imports rugby goggles to sell here and how they’re struggling with tariffs. When are the rugby goggle factories likely to spring up in the US?

And for those saying this puts us more in line with what Europeans have been paying. Maybe, but you guys get to live in Europe!

These new fees aren’t being collected to help small businesses or to fund social services (not here, we hardly have any left), they’re explicitly supposed to offset the costs of tax breaks for the rich.

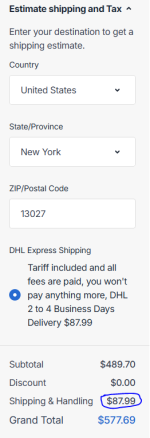

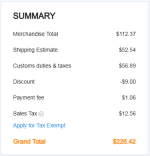

Anyway, somewhat more on point, placed a Mouser order yesterday the breakdown was:

Merchandise - $189.60

TX state sales tax - $18.65

Shipping - $8.89

Tariff - $27.55

So, looks like somewhere around 15% added to your order total. I didn’t really scrutinize my order to see if it seemed like the same rate across different types of components. But they do give it to you per item, so some bored individual could make a pie chart or something

Last edited:

Maybe, over here cheap imports bypassing any VAT or import duty are effecting the larger retail chains and the independentExcept that businesses specifically competing with ‘Chinese fast fashion’ were more likely to be large retail chains and not independent mom-n-pops.

And of course there’s all the small specialty shops that rely on imports of stuff that will never make sense to manufacture in the US. Just read an article about a shop that imports rugby goggles to sell here and how they’re struggling with tariffs. When are the rugby goggle factories likely to spring up in the US?

And for those saying this puts us more in line with what Europeans have been paying. Maybe, but you guys get to live in Europe!

These new fees aren’t being collected to help small businesses or to fund social services (not here, we hardly have any left), they’re explicitly supposed to offset the costs of tax breaks for the rich.

Anyway, somewhat more on point, placed a Mouser order yesterday the breakdown was:

Merchandise - $189.60

TX state sales tax - $18.65

Shipping - $8.89

Tariff - $27.55

So, looks like somewhere around 15% added to your order total. I didn’t really scrutinize my order to see if it seemed like the same rate across different types of components. But they do give it to you per item, so some bored individual could make a pie chart or something

For something like Rugby googles, I imagine it will work like VAT and the small business will just pass the cost onto the consumer - there's nothing inherently wrong with that, and it's not much different to the state's sales tax being added onto the cost - the issue is if the American consumer and economy is ready for the prices on everything to go up 10-50%?

As to what your government spends any monies collected on, you live in a democracy, with a constitution and checks and balances, so theoretically the American people get to decide that?

pricklyrobot

Well-known member

What’s wrong with it in this case is that the supposed aim of the tariff is to encourage increased manufacturing in the US. But if you slap non-strategic tariffs on everything, you wind up including specialty items (like rugby goggles for one example) that will never plausibly be manufactured in the US due to very limited demand.For something like Rugby googles, I imagine it will work like VAT and the small business will just pass the cost onto the consumer - there's nothing inherently wrong with that…

So, increased prices with no plausible benefit for the US citizen/consumer.

That’s without even delving into the (fairly large) number of people who claim to support domestic manufacturing vs. the (very much smaller) number of people who say they’d actually like a factory job. Or the fact that the people touting these great manufacturing jobs on the horizon also tend to be enthusiastic union-busters…

* Hands up everybody who wants to head to North Carolina and man the looms in the newly re-shored ‘right to work’ textile mill

Last edited:

giovanni

Well-known member

Bless your heart!so theoretically the American people get to decide that?

I meant there's nothing wrong with the concept of a tax that's passed onto the consumer. In the case of the current US tariffs... it's a shocking shambles when a supposedly democratic system with checks and balances SO quickly gets taken apart so some self proclaimed king apply capricious egocentric tarriffs on countries at his own whim and supposedly able to be flattered to lower numbers by personal gifts and promises. It's bad democracy and it's bad economics that will just hurt the American population more than anything - and it won't work, because now the whole world has realised - you can't rely on the dollar, and you know what the US isn't actually going to support the ecconomic and defence systems it's carefully built for the last 70 years - so they will go elsewhere... thats why you saw china and india come to a recent agreement... oh and cut all your soft power and dismantle USAID while you're about it... and so what if your main friend in the Middle East based their health system on it... but of course that soft power didn't have a dollar value so the man child couldn't count it... and lets not even get started on the omnishambles of betraying Ukraine and silently allowing genocide in Palestine...What’s wrong with it in this case is that the supposed aim of the tariff is to encourage increased manufacturing in the US.

But wahoo tarriffs - make America great again... gerrymander the majority, and onshore the jobs in that factory that doesn't exist, with the workers you've not trained and oh shit, the raw materials for your good old USA rugby googles are now under a 50% tariff - and you can't get them anyway - because when USAID pulled out the Chinese stepped in exchange for the raw ingredients. Woop do doo.

And in this wonderful democracy, we now have the joy that if I ever visited on a tourist visa I would get stopped by immigration asked about this post on pedalPCB, and locked up for days/weeks without contact with anyone for no other reason than we all learned in school/starwars an authoritarian state doesn't work without an 'other' that can live in fear....

I agree with you

I cant imagine Europeans claiming that because of tariffs the US is paying what Europeans are used to.

Theoretically within a democracy you can choose to give it up for a autocrazy.As to what your government spends any monies collected on, you live in a democracy, with a constitution and checks and balances, so theoretically the American people get to decide that?

Big Monk

Well-known member

I've got a JLCPCB order to do today. Very scary stuff.

pricklyrobot

Well-known member

My country is a roaring dumpster fire and I won’t have anyone say otherwise!…I agree with you

‘Murica

Big Monk

Well-known member

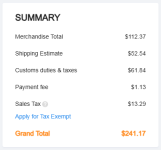

Here is my JLCPCB Order from today:

I ordered:

20 - PCBA Boards for V2 125B Electric Monktress

10 - Standard (Through Hole) V2 1590XX Electric Monktress

5 - 1590XX Vibe Prototype

100 - 3PDT Universal Bypass Boards

50 - 125B I/O Boards

25 - 1590XX I/O Boards

20 - 125B Nameplates

10 - 1590XX Nameplates

I ordered:

20 - PCBA Boards for V2 125B Electric Monktress

10 - Standard (Through Hole) V2 1590XX Electric Monktress

5 - 1590XX Vibe Prototype

100 - 3PDT Universal Bypass Boards

50 - 125B I/O Boards

25 - 1590XX I/O Boards

20 - 125B Nameplates

10 - 1590XX Nameplates

Attachments

BuddytheReow

Moderator

At least you picked up the $9 discount, lolHere is my JLCPCB Order from today:

View attachment 102333

I ordered:

20 - PCBA Boards for V2 125B Electric Monktress

10 - Standard (Through Hole) V2 1590XX Electric Monktress

5 - 1590XX Vibe Prototype

100 - 3PDT Universal Bypass Boards

50 - 125B I/O Boards

25 - 1590XX I/O Boards

20 - 125B Nameplates

10 - 1590XX Nameplates

Big Monk

Well-known member

At least you picked up the $9 discount, lol

To be clear, just the raw calcs comes out to $7.30 per pedal, and that includes main board, switch board, I/O board plus the nameplate.

That's not bad at all. That's still less than my $10 per pedal threshold. And even that's not my hard line in the sand, but more like my warning alert.

Similar threads

- Replies

- 13

- Views

- 1K