You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Should I expect to pay Tariffs on Tayda Orders?

- Thread starter ThatDude

- Start date

Robert

Reverse Engineer

What a truly awesome, necessary thing to put your citizens through!

I paid $750 in tariffs on parts this weekend that were manufactured in the USA... and I'm in the USA.

CheapSuitG

The TubeSchemer

Sounds logical comparatively.I paid $750 in tariffs on parts this weekend that were manufactured in the USA... and I'm in the USA.

zeropluszero

Well-known member

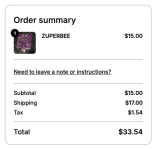

An australian is generally up about $22usd for 3 or more $8 pcbs from PPCB, and we dont even have that tariff mess.Non-Tayda, but... YAYYYY $17 shipping/fees on a single $15 pcb from Canada now. Absolutely not DEFX's fault of course, they have to lump it all in. What a truly awesome, necessary thing to put your citizens through!

View attachment 102979

(Not a complaint Robert, just an observation)

Erik S

Well-known member

oooh, I didn't even know about CE. I'll have to remember that.Tayda’s pretty much my last resort now. CE Dist, StompBox Parts,My Switches, Mouser, and DigiKey are my go-tos for pedal and amp parts now.

I tend to place a couple very large orders a year and honestly the biggest advantage of Tayda for me is how fast I can navigate their website. The idea of needing to order all my basic caps and resistors from Mouser sounds awful. SBP is also great - they get all of my knob business and anything they have that Tayda doesn't.

I'm as annoyed about tariffs as anyone, but I guess I've assumed that even with the tariffs, Tayda would still be my cheapest option. Even if their price advantage got erased, it seems like if I had to get my Tayda order from three other places, the additional shipping might be worse than the tariffs.

Also a factor is that whenever I feel like someone in authority is trying to manipulate me into a particular course of action my instinct is to do the opposite.

Ginsly

Well-known member

CE Distribution looks to be yet another name for Antique Electronic Supply/Amplified Parts... same exact inventory as far as I can tell. AES and AP are finally merging, I wonder if CE will remain.oooh, I didn't even know about CE. I'll have to remember that.

jessenator

Well-known member

That's so weird to have that many DBAs…

Harry Klippton

Well-known member

It's been said around here many times. CE is the wholesale arm of the company. You need a business license to open an account with them

Ginsly

Well-known member

Wow, I actually heard the exasperated sigh when I read that!It's been said around here many times.

PunchySunshine

Well-known member

My local coffee place just upped their price for a 1# bag of beans from $21 to $29 citing tariffs. In 2020 it was $18 a bag. It's all fu@kered now.

falco_femoralis

Well-known member

A large soda at McDonald's is now $2 instead of $1. A 100% increase in cost, outrageous

thomasbe86

Well-known member

I've got a real life example finally for a company in Switzerland selling pedals to the U.S. after the end of the 800 USD de minimis.

The Swiss Post only accept to ship to the U.S. if we pre pay the custom fee. Here is a breakdown:

Adding the PayPal fee, 12 USD and that gives you a 130 USD cost to sell a 179 USD pedal to a U.S. customer

Out of the 49 USD left, I still donate 5% of the selling price to a local food bank (that's on me), that's 8.95 USD.

You've 40.05 USD left to get your PCB, coffee, components, pizza, parts, beer, enclosure, etc.

In 2025 so far, the U.S. represents 18.45% of our customers.

We are doing it for this month for fun and then we'll change our system, either increase the price, charge shipping, no idea, but we will change something for sure.

The tough part is that customers from most countries already pay some sort of fee at delivery themselves, and that's just how it is. Anytime I buy something from abroad here in Switzerland, I have to pay a custom fee to the brokerage and then the Swiss VAT. That is just how it is. I've never thought the seller should cover these.

If we decide to absorb the cost for the U.S. customers, why not absorb it for the rest of the world?

I'm not sobbing, this is a hobby and never made money on this, but I can't imagine how companies who do this as a full gig can go through this without trying to find another customer base.

thoughts?

The Swiss Post only accept to ship to the U.S. if we pre pay the custom fee. Here is a breakdown:

- Pedal is sold 179 USD

- Shipping: 34.30 USD

- Customs (39%): 69.81 USD

- Disbursement Fee (2%): 2.98 USD (I have no idea what that is)

- PDDP (Postal Delivered Duty Paid) Fee: 12.01 USD

Adding the PayPal fee, 12 USD and that gives you a 130 USD cost to sell a 179 USD pedal to a U.S. customer

Out of the 49 USD left, I still donate 5% of the selling price to a local food bank (that's on me), that's 8.95 USD.

You've 40.05 USD left to get your PCB, coffee, components, pizza, parts, beer, enclosure, etc.

In 2025 so far, the U.S. represents 18.45% of our customers.

We are doing it for this month for fun and then we'll change our system, either increase the price, charge shipping, no idea, but we will change something for sure.

The tough part is that customers from most countries already pay some sort of fee at delivery themselves, and that's just how it is. Anytime I buy something from abroad here in Switzerland, I have to pay a custom fee to the brokerage and then the Swiss VAT. That is just how it is. I've never thought the seller should cover these.

If we decide to absorb the cost for the U.S. customers, why not absorb it for the rest of the world?

I'm not sobbing, this is a hobby and never made money on this, but I can't imagine how companies who do this as a full gig can go through this without trying to find another customer base.

thoughts?

Fama

Well-known member

To be fair, for a lot of sites you have to prepay the tax, so it would make sense for the US customers to have to pre-pay this tax (which it essentially is) too. Even the intended function of tariffs (not sure what was intended in this case, but in general) is that the customer pays more for foreign purchases, not that the seller absorbs the cost.If we decide to absorb the cost for the U.S. customers, why not absorb it for the rest of the world?

Of course the issue is that for small sellers it's not necessarily easy to implement, plus platforms won't support it because it all happened so fast. There are really no good solutions.

Robert

Reverse Engineer

Anybody order from LCSC (shipped to USA) recently? Wondering about tariffs/fees, and a cursory search was looking pretty rough…

I received a fairly big shipment yesterday. They claimed duties would be owed but so far nothing.

I believe FedEx will bill you after receiving the shipment though, so I may not be in the clear just yet.

Ginsly

Well-known member

Gotcha, thanks Robert- keep us posted if that changes!I received a fairly big shipment yesterday. They claimed duties would be owed but so far nothing.

I believe FedEx will bill you after receiving the shipment though, so I may not be in the clear just yet.

Sometimes FedEx just sends me a bill a month later, and sometimes they send me a link to pay it prior ...I received a fairly big shipment yesterday. They claimed duties would be owed but so far nothing.

I believe FedEx will bill you after receiving the shipment though, so I may not be in the clear just yet.

benny_profane

Well-known member

This is, I think, particularly vexing for US folks because we have never really had a consumer-facing, across the board federal consumption tax like this in recent memory. States/local authorities have sales tax (tax on top of eligible goods at point of purchase). Federal consumption taxes exist in excise taxes for things like tobacco, gasoline, airline tickets, but those are factored into the price and not seen. The US primarily taxes through federal income tax and payroll taxes.The tough part is that customers from most countries already pay some sort of fee at delivery themselves, and that's just how it is. Anytime I buy something from abroad here in Switzerland, I have to pay a custom fee to the brokerage and then the Swiss VAT. That is just how it is. I've never thought the seller should cover these.

A vendor wants to be able to provide a price to a consumer, but these tariffs are ever changing and the collection process is not settled. I get why vendors may want to absorb it when there’s that much confusion (Will it be collected? How much will it be?). If these stick around, it cannot realistically be expected for vendors to absorb these indefinitely.

People now can buy directly from overseas markets without going through an intermediary seller. The sheer volume alone of that B2C business seems, to me at least, a huge barrier to implementing this with existing systems.