Doesn't Mouser ship from the US?About $7 in estimated Tariff on a $53 Mouser order today. I ordered a bunch of stuff in bulk so not a huge deal, but just so everyone has a landmark for Mouser...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Jlcpcb and tariffs

- Thread starter Locrian99

- Start date

benny_profane

Well-known member

They’ve been indicating tariff prices since the semiconductor tariffs started in January. They are passing it through to the customer but as a specific line item rather than in the price.Doesn't Mouser ship from the US?

pricklyrobot

Well-known member

My Mouser orders ship from TX. They may have multiple distribution centers, I’m not sure.Doesn't Mouser ship from the US?

But a good chunk of their inventory probably comes from tariffed countries, so they’re giving it too you as a line item rather than just doing across-the-board price increases.

I’ve seen other businesses doing the same thing lately.

I’m putting together a pretty big Mouser order at the moment, I’ll report back here with my tariff totals when I finish.

PedalBuilder

Well-known member

The Federal Circuit just affirmed the Court of International Trade's ruling that the tariffs imposed by five executive orders were illegal because they were not authorized by statute. The ruling is on hold through October 14 to allow the government the opportunity to file a petition for a writ of certiorari in the Supreme Court. The opinion is here, for those interested.

jdduffield

Active member

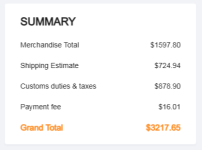

I noticed a huge increase in shipping costs for Tayda. And only one option, DHL. I hope that’s temporary. Usually the more you buy, the lower the shipping costs. Now it just keeps going up. (Talking about the estimate shown in the cart.)

jessenator

Well-known member

how long before his oberstgerichtshof overrules this one?The ruling is on hold through October 14 to allow the government the opportunity to file a petition for a writ of certiorari in the Supreme Court.

PedalBuilder

Well-known member

Not sure what an oberstgerichensgrubentshoffenzolenz is, but I'm very skeptical that I can count to five in support of the proposition that IEEPA authorizes the president to unilaterally impose tariffs of unlimited duration on nearly all goods from nearly every country in the world.

jessenator

Well-known member

Bad joke. I'm not well versed in how the appeals process works and just assumed the supreme pizza court would just do the bidding of the guy giving the edicts.

I'm prepared, just not happy.

I'm prepared, just not happy.

Audandash

Well-known member

877 cash nowCall J. G. Wentworth

benny_profane

Well-known member

“Oh you did something so uniquely illegal that there’s no precedent? Have another six weeks of doing it just for funsies.”The Federal Circuit just affirmed the Court of International Trade's ruling that the tariffs imposed by five executive orders were illegal because they were not authorized by statute. The ruling is on hold through October 14 to allow the government the opportunity to file a petition for a writ of certiorari in the Supreme Court. The opinion is here, for those interested.

I'm brand new here. Wanting to make an order from Tayda and a PCB from JLC. Curious if DHL will now demand a big tariff payment for my package. Hate this timeframe. Trying to put together a similar order from Mouser or Digikey...but finding similar products from the insane selection there is driving me crazy! Back to PCB design I guess. lol

Looking at it in a balanced way - some of the changes are positive and needed, possibly not great for pedal builders but I think that removal of de minimis on duty is a positive thing - it will stop Chinese fast fashion brands being able to undercut the system of import duties and safety requirements - that overall will be a positive thing for American economy and worker and will give a semblance of fairness to shops trying to operate in the US.

On the other hand, vindictive personal vendettas and personal gifts to the president is a crazy way for any country to manage trade and foreign policy and clearly has to be illegal if that constitution is still something y’all believe in?

As an outsider looking in the speed of the slide into authoritarianism in the US is crazy.

On the other hand, vindictive personal vendettas and personal gifts to the president is a crazy way for any country to manage trade and foreign policy and clearly has to be illegal if that constitution is still something y’all believe in?

As an outsider looking in the speed of the slide into authoritarianism in the US is crazy.

that's less than 20% including shipping.This is an enclosure order including 20 125B and 10 1590XX enclosures. I don't hate it, especially if it's a no-snag option with respect to tarrifs but it is a distinct change. This is about $20 per finished enclosure in the raw sense, but it's obviously skewed by the 1590XX enclosures are twice as much as the 125B:

View attachment 102240

The rest of the world would pay (subtotal + shipping) x VAT - which in the UK is 20% .

that's less than 20% including shipping.

The rest of the world would pay (subtotal + shipping) x VAT - which in the UK is 20% .

Plus import charge if over 136 IIRC now. It’s all caused mass chaos as all rapid import/export changes do.

pricklyrobot

Well-known member

Except that businesses specifically competing with ‘Chinese fast fashion’ were more likely to be large retail chains and not independent mom-n-pops.Looking at it in a balanced way - some of the changes are positive and needed, possibly not great for pedal builders but I think that removal of de minimis on duty is a positive thing - it will stop Chinese fast fashion brands being able to undercut the system of import duties and safety requirements - that overall will be a positive thing for American economy and worker and will give a semblance of fairness to shops trying to operate in the US.

And of course there’s all the small specialty shops that rely on imports of stuff that will never make sense to manufacture in the US. Just read an article about a shop that imports rugby goggles to sell here and how they’re struggling with tariffs. When are the rugby goggle factories likely to spring up in the US?

And for those saying this puts us more in line with what Europeans have been paying. Maybe, but you guys get to live in Europe!

These new fees aren’t being collected to help small businesses or to fund social services (not here, we hardly have any left), they’re explicitly supposed to offset the costs of tax breaks for the rich.

Anyway, somewhat more on point, placed a Mouser order yesterday the breakdown was:

Merchandise - $189.60

TX state sales tax - $18.65

Shipping - $8.89

Tariff - $27.55

So, looks like somewhere around 15% added to your order total. I didn’t really scrutinize my order to see if it seemed like the same rate across different types of components. But they do give it to you per item, so some bored individual could make a pie chart or something

Last edited:

Maybe, over here cheap imports bypassing any VAT or import duty are effecting the larger retail chains and the independentExcept that businesses specifically competing with ‘Chinese fast fashion’ were more likely to be large retail chains and not independent mom-n-pops.

And of course there’s all the small specialty shops that rely on imports of stuff that will never make sense to manufacture in the US. Just read an article about a shop that imports rugby goggles to sell here and how they’re struggling with tariffs. When are the rugby goggle factories likely to spring up in the US?

And for those saying this puts us more in line with what Europeans have been paying. Maybe, but you guys get to live in Europe!

These new fees aren’t being collected to help small businesses or to fund social services (not here, we hardly have any left), they’re explicitly supposed to offset the costs of tax breaks for the rich.

Anyway, somewhat more on point, placed a Mouser order yesterday the breakdown was:

Merchandise - $189.60

TX state sales tax - $18.65

Shipping - $8.89

Tariff - $27.55

So, looks like somewhere around 15% added to your order total. I didn’t really scrutinize my order to see if it seemed like the same rate across different types of components. But they do give it to you per item, so some bored individual could make a pie chart or something

For something like Rugby googles, I imagine it will work like VAT and the small business will just pass the cost onto the consumer - there's nothing inherently wrong with that, and it's not much different to the state's sales tax being added onto the cost - the issue is if the American consumer and economy is ready for the prices on everything to go up 10-50%?

As to what your government spends any monies collected on, you live in a democracy, with a constitution and checks and balances, so theoretically the American people get to decide that?

pricklyrobot

Well-known member

What’s wrong with it in this case is that the supposed aim of the tariff is to encourage increased manufacturing in the US. But if you slap non-strategic tariffs on everything, you wind up including specialty items (like rugby goggles for one example) that will never plausibly be manufactured in the US due to very limited demand.For something like Rugby googles, I imagine it will work like VAT and the small business will just pass the cost onto the consumer - there's nothing inherently wrong with that…

So, increased prices with no plausible benefit for the US citizen/consumer.

That’s without even delving into the (fairly large) number of people who claim to support domestic manufacturing vs. the (very much smaller) number of people who say they’d actually like a factory job. Or the fact that the people touting these great manufacturing jobs on the horizon also tend to be enthusiastic union-busters…

* Hands up everybody who wants to head to North Carolina and man the looms in the newly re-shored ‘right to work’ textile mill

Last edited:

Similar threads

- Replies

- 51

- Views

- 15K

- Replies

- 11

- Views

- 2K

- Replies

- 11

- Views

- 2K